Excess funds at start of quarter of 11000000 earns 110000 in income. Amount a business earns in excess of all expenses and costs.

Solved Check My Work Match Each Of The Descriptions With The Chegg Com

An excess business loss is an amount by which total business deductions are greater than a threshold amount currently total gross income and gains plus 250000 or 500000 for a joint return.

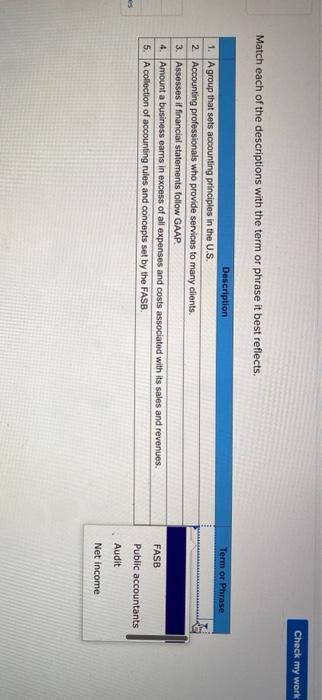

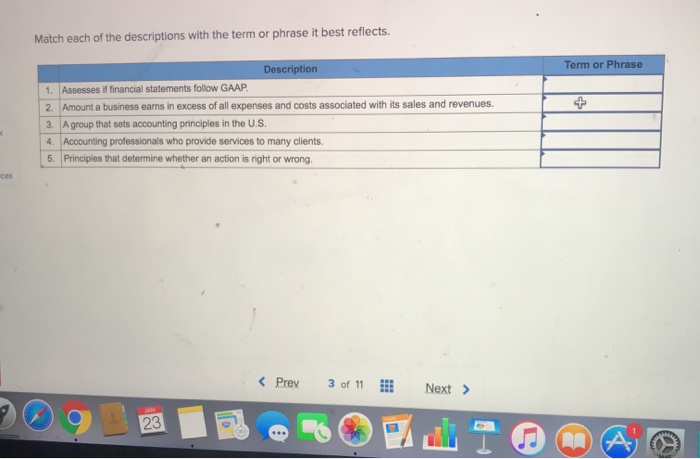

. It can be mathematically calculated as Profit Total revenue - Total expenses. A collection of accounting rules and concepts set by the FASB FASB Public accountants Audit Net Income Match each of the descriptions with the term or phrase it best reflects. 116 million minus all other fixed and variable expenses associated with operating the business such as rent utilities and payroll Profit or Net income.

None of the above. Jon has recently redesigned his blog taking it to the next level in terms of professionalism. Since most small businesses are tax pass through entities it is beneficial to the business to have the least amount of net income in order to reduce the tax obligations of the owners.

As the article says the major income stream. Generally the first 1000 of unrelated income is not. None of the above.

C Corporation Income Taxation. An employee earns 25 per hour and 2 times that rate for all hours in excess of 40 hours per week. Non-deductible Expenses not incurred wholly The whole and exclusively for the production amount of income Business entertainment expenses amount in excess of 1 of the gross income or 17086 whichever is lower.

Excess funds at start of quarter of 11482222 earns 114822 in income. CHAPTER 18 C-49 Q1. 116 million a loss.

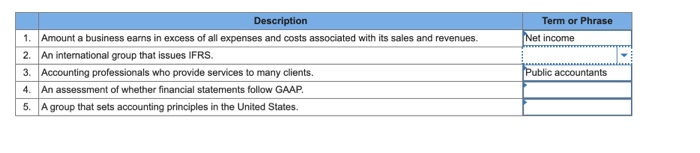

Receipts must be submitted within X days of the expense. The contribution margin is the amount remaining ie. Amount a business earns in excess of all expenses and costs associated with its sales and revenues.

For tax years beginning after 2017 the deduction for business interest expense cannot exceed the sum of the taxpayers. Amount a business earns in excess of all expenses and costs associated with its sales and revenues. It is the difference between the total money earned and the total expenses occurred during the production and marketing process of the product.

Limit on NOL Deduction. Excess business interest income is the amount by which a partnerships or S corporations business interest income exceeds its business interest expense in a taxable year. Any interest in excess of those amounts is limited to 30 of adjusted taxable income.

Profit can be defined as the excess amount of revenue over the total expenses including salaries. While nonprofits can usually earn unrelated business income without jeopardizing their nonprofit status they have to pay corporate income taxes on it under both state and federal corporate tax rules. Based on the total variable expenses per pizza Restaurant ABC must price.

Excess business interest expense is the amount of disallowed business interest expense of the partnership for a taxable year. 30 of adjusted taxable income ATI for the year or zero if the taxpayers ATI is less than zero. Disallowed interest expense may be carried forward indefinitely.

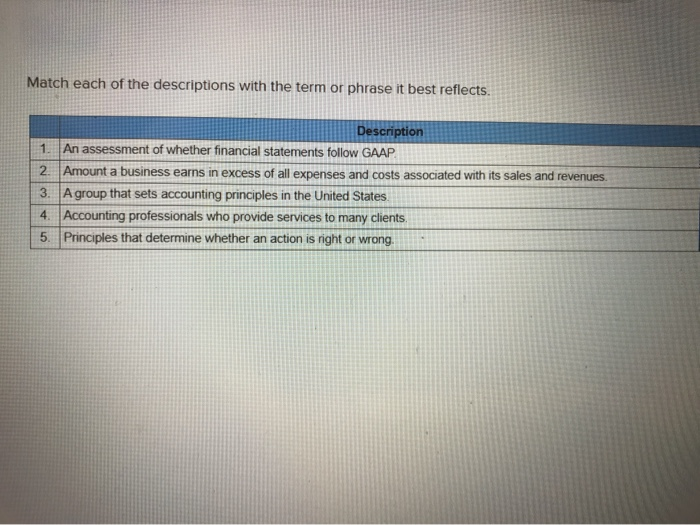

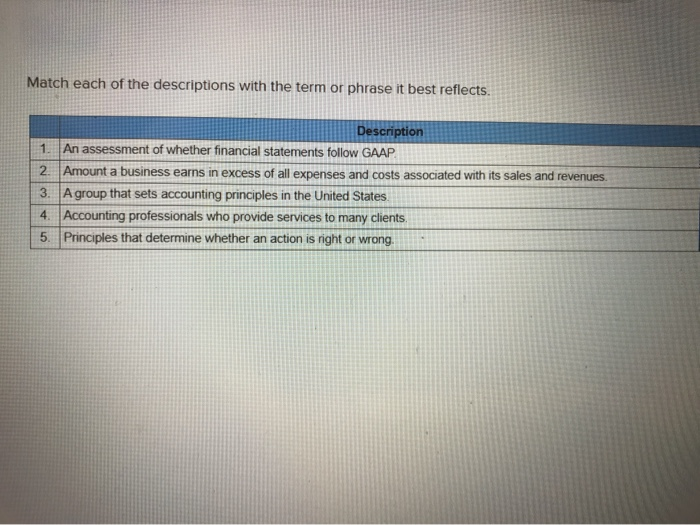

All miscellaneous deductions were deductible in excess of 2 of adjusted gross income AGI. One of the more significant nondeductible expenses for the small business owners are income taxes. A group that sets accounting principles in the United States.

Rory is surprised to learn that there are many other types of income besides the wages he earns in this paycheck every month. The amount an individual or business earns after subtracting deductions and taxes from gross income. Sometimes nonprofits make money in ways that arent related to their nonprofit purposes.

Accounting professionals who provide services to many clients. The following expenses are not deductible in calculating taxable income. Fortune has a fantastic article on Google that features problogger Jon Gales from Mobile Tracker a blog about cell phones which is a fantastic example of a blog which is being used very effectively to earn its ownereditor a decent income.

Which amount should be recorded as income in his income and expense statement. Usually an invoice will be sent with payment due at a later date. Adjusted taxable income means taxable income computed without regard to.

The IRS stipulates a reasonable amount of time Any employer advance in excess of business expenses is returned or the excess amount is reported on the employees W-2. An expense report is signed by a supervisor and it also details the reasons for each claimed expense. Assume further that the social security tax rate was 60 the Medicare tax rate was 15 and federal income tax to be withheld was 23915.

Assume that the employee worked 48 hours during the week. Prior to the TCJA unreimbursed employee business expenses were deductible as a miscellaneous deduction on an individuals return. To calculate the net income of a business subtract all expenses and costs from revenue.

This is achieved by making sure every dollar expensed is deductible for tax purposes. Earned profit is the amount a business earns after taking into account all expenses. Business interest income for the tax year.

On Credit An agreement for an individual or company to pay for a good or service later. The amount a business earns after business expenses and deductions are taken out is called A. Excess funds at start of quarter of 11869267 earns 118693 in income.

Floor plan financing interest expense Sec. For example if your AGI was 100000 in 2017 you could claim only a deduction for the amount of your total miscellaneous. Be aware that business interest income and expense dont include investment interest income or expense.

You can calculate this number by subtracting the costs that go into your companys operations from your sales. There are limits to the amount of a net operating loss you can take in one year for tax years after 2017. An assessment of whether financial statements follow GAAP.

The amount a business earns after business expenses and deductions are taken out is called A.

Solved Term Or Phrase Net Income Description 1 Amount A Chegg Com

Solved Match Each Of The Descriptions With The Term Or Chegg Com

0 Comments